Huawei’s automotive industry chain companies have made new moves.

On the evening of September 2, Huawei Hongmeng Intelligent Driving PartnerBAIC Blue Valley(600733.SH) announced that its subsidiary BAIC New Energy will receive no more than 12 billion yuan in additional capital. BAIC New Energy plans to increase capital and expand shares by introducing strategic investors through public listing, with the amount of additional capital not exceeding 10 billion yuan; at the same time, BAIC Blue Valley shareholder Beijing Auto plans to increase capital to BAIC New Energy by 2 billion yuan.

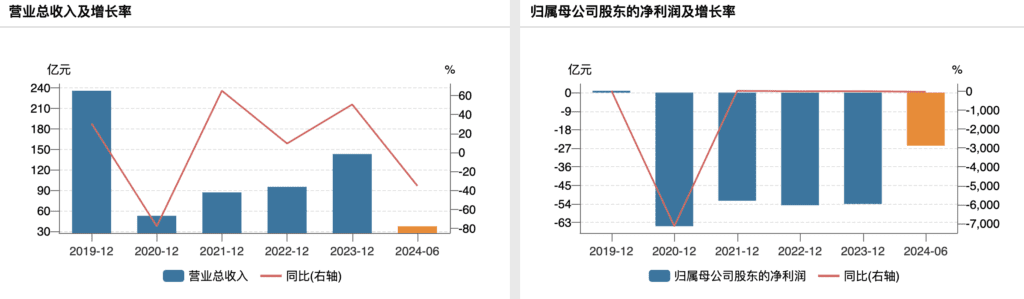

Behind the introduction of huge amounts of funds, perhaps the company’s anxiety about funds is reflected. Titanium Media APP noted that BAIC Blue Valley has been in a loss-making state for four and a half years, with cumulative losses exceeding 25 billion yuan during this period, causing the company to spend more than it earns and its debt ratio continues to rise. In addition, while China’s new energy vehicle sales growth rate rose sharply in the first half of the year, the company’s car sales showed a year-on-year decline.

At present, the company hopes to expand market space with Xiangjie S9. However, whether Xiangjie can replicate the “sales myth” of Wenjie and save the performance of BAIC Blue Valley still needs further verification by the market.

Plans to increase capital and expand shares, with a maximum investment of 12 billion

In the announcement, BAIC BluePark stated that in order to meet the needs of business development, enhance the company’s competitiveness, and optimize the capital structure, its subsidiary BAIC New Energy plans to increase capital and expand shares by introducing strategic investors through public listing. The capital increase price will not be lower than the registered valuation results, and the amount of capital increase will not exceed 10 billion yuan.

At the same time, BAIC BluePark’s shareholder Beijing Auto also announced that it plans to increase its capital by 2 billion yuan to its subsidiary BAIC New Energy, which means that after the above two plans are successfully implemented, BAIC New Energy will receive no more than 12 billion yuan in capital injection.

In terms of equity structure, BAIC BluePark directly holds 99.99% of BAIC New Energy’s equity and holds 0.01% of BAIC New Energy’s equity through Beijing BluePark Polar Fox Automotive Technology Co., Ltd., and holds a total of 100% of BAIC New Energy’s equity. The company said that after the implementation of this capital increase, it will still be the controlling shareholder of BAIC New Energy.

Public information shows that BAIC New Energy was established in October 2009 and is the first company in my country to obtain the qualification to produce new energy vehicles. The company’s registered capital is 10.798 billion yuan. At present, BAIC New Energy has new energy vehicle brands such as Polar Fox and Enjoy. The models on sale mainly include Alpha T5, Alpha T, Alpha S, Alpha S5, Polar Fox Koala, Enjoy S9, etc.

Among them, Xiangjie is jointly built by BAIC New Energy and Huawei, so it has attracted much attention from the market. It is reported that in Miyun, Beijing, BAIC New Energy has built the BAIC New Energy Xiangjie Super Factory specifically for Xiangjie S9, with an investment of up to 1.6 billion yuan, and the current production capacity is 120,000 vehicles.

However, it is not easy for BAIC to replicate the “sales myth” of the Xiangjie. Data shows that this year, the order volume of the Xiangjie S9 exceeded 4,800 units within 72 hours of its launch, and the order volume of the Wenjie M9 exceeded 10,000 units within one hour of its launch.

In terms of performance, Beijing New Energy’s net profit continued to lose money from 2021 to 2023, with losses of 3.74 billion yuan, 2.54 billion yuan, and 2.18 billion yuan respectively. In the first half of this year, the company has not yet gotten out of the quagmire of losses, with a loss of 1.2 billion yuan.

With a huge debt burden, the money-burning model may be unsustainable

Titanium Media APP noticed that behind this capital increase, BAIC Blue Valley’s debt ratio rose sharply.

As of the end of the first half of this year, BAIC BluePark’s asset-liability ratio has reached 85.02%, a significant increase from 68.37% in the same period last year. Specifically, the company’s cash on hand is 2.304 billion yuan, while its short-term loans are 5.689 billion yuan and its long-term loans are 1.693 billion yuan, facing certain debt repayment pressure.

This is also closely related to the company’s continued losses in recent years.

In fact, BAIC Blue Valley has been losing money for four consecutive years, with losses of 6.482 billion yuan, 5.244 billion yuan, 5.465 billion yuan, and 5.4 billion yuan from 2020 to 2023, totaling 22.591 billion yuan. Adding the losses in the first half of 2024, the company has lost a total of 25.162 billion yuan in four and a half years.

Data source: Wind

According to data from the China Association of Automobile Manufacturers, in the first half of 2024, China’s new energy vehicle market once again demonstrated strong growth momentum. In the first half of the year alone, China’s production and sales of new energy vehicles reached 4.929 million and 4.944 million respectively, year-on-year growth of 30.1% and 32.0% respectively, and market share increased to 35.2%.

However, BAIC BluePark’s performance in the first half of the year was disappointing, with car sales of only 28,000 units, a significant decline from 35,000 units in the same period last year, and far behind the 32% growth rate of China’s new energy vehicle sales.

According to the semi-annual report, BAIC BluePark achieved operating income of 3.741 billion yuan in the first half of this year, a year-on-year decrease of 35.16%; the net profit attributable to shareholders of the listed company was -2.571 billion yuan, a 29.88% increase from the same period last year. Due to the decline in sales and revenue, the company’s cash flow also deteriorated, with operating cash flow of -2.057 billion yuan in the same period.

It is worth noting that the company’s gross profit margin has also continued to decline. In the first half of this year, BAIC Blue Valley’s gross profit margin was -7.05%, a further decline of 2 percentage points from -5.01% in the same period last year. During the same period, the company’s net profit margin was -67.64%, while the figure in the same period last year was -34.08%. This also means that with the continuous increase in debt ratio, the company’s money-burning model may be unsustainable.

Regarding the loss in the first half of the year, the company explained that competition in the new energy vehicle market is becoming increasingly fierce, price wars are becoming increasingly fierce, squeezing profit margins; in order to continuously promote the development of products towards high-end, the company continues to invest in technology research and development, brand channel construction, brand image sharpening, and operational efficiency improvement, which has a certain impact on the company’s short-term performance.

Faced with fierce market competition, the company can only continue to increase its investment in product technology research and development, and continuously launch innovative and competitive new energy vehicle products.

Zhao Ji, secretary of the board of directors of BAIC Blue Valley, recently said that as an important strategic layout for the second half of the year, the Enjoy S9 is likely to further release the development potential of BAIC New Energy and open up more market imagination space. In addition, the company will continue to focus on the high-end brand image of Polar Fox, continue to expand the volume of communication, and strengthen the brand image and value perception. However, whether the high-end and Enjoy S9 can save the performance of BAIC Blue Valley remains to be verified by the market.

In the secondary market, due to the Huawei concept, from February 6 to July 17 this year, the share price of BAIC Blue Valley rose by more than 180%, reaching a high of 10.61 yuan. Then the company’s share price fluctuated and fell. As of the close of September 3, BAIC Blue Valley reported 6.8 yuan, with a cumulative increase of 10.93% this year and a total market value of 37.9 billion yuan.

(This article was first published on Titanium Media APP, author | Zhai Biyue, editor | Cao Shengyuan)

For more exciting content, follow Titanium Media WeChat ID: taimeiti, or download the Titanium Media App