Written by | Hongcan Network

In the first half of this year, reports of Xie Yao, the founder of milk tea brand “Yuan Zhenzhen,” selling milk tea at a street stall became the talk of the towns across China.

Founded in 2019, Yuan Zhenzhen once reached a peak with 300 stores across the country and an annual revenue of nearly 40 million yuan.

However, the good times did not last long. Starting from the first half of 2022, with the accelerated expansion of leading brands and the onset of a price war, Yuan Zhenzhen’s performance plummeted, and its cash flows became increasingly tight, leading to the closure of numerous stores.

By the time the last directly-operated store announced its closure in 2023, Yuan Zhenzhen had accumulated losses exceeding 10 million yuan, and the founder had “fallen” to selling milk tea at a street stall. In the comments section of a video where Xie shared his entrepreneurial experience, a franchisee left this comment: “You lost 10 million yuan, I lost 200,000 yuan, all because I joined you.“

Regrettably, many industry participants ignored the warning signs that had long been sounded, and by the time the avalanche hit, it was too late to escape. Currently, the wave of closures in the milk tea industry is intensifying.

According to Hongcan Big Data, from November last year to November this year, as many as 197,000 milk tea shops have closed down. This wave of closures has affected not only the first-tier and quasi-first-tier brands and thousands of franchisees who once aimed for ten thousand stores but also many entrepreneurs driven by the entrepreneurial wave into the milk tea sector.

Behind the cold number “197,000” are not only the plummeting stock prices and performance of giants but also the losses of tens of thousands of entrepreneurs and franchisees, along with countless shattered dreams.

Amid the Wave of Shop Closures, Survival for 1.5 Years Seen as “Outperformance”

How long can a newly opened milk tea shop last now?

The answers from shop owners are increasingly worrying: from half a year to 3 months, the survival time is getting shorter. In comparison, managing to last a year and a half seems to be considered “longevity.”

Wang Wangwang spent five years of savings to open her own milk tea shop. She designed the logo and packaging herself, sourced raw materials through her own channels, and managed everything personally. After struggling for over a year, she ended up losing 300,000 yuan. In late August, she decided to close the shop to cut her losses.

Wang Wangwang transitioned from the agricultural products industry to the catering industry, thinking that mastering the formula and upstream raw material procurement chain would be enough to successfully open a milk tea shop. However, he stumbled over barriers in location selection, operations promotion, and platform negotiations.

Unlike Wang Wangwang, who created his own brand, Liz joined a relatively unknown third-tier tea brand in her area. She invested over 400,000 yuan, opened her store in February, and closed it during the peak summer vacation season in August, surviving less than six months.

When planning to open the store, Liz thought that joining a non-first-tier brand was a more cost-effective choice, considering that entry fees for top brands often start at millions. However, she didn’t expect that the downside of being cheap is extremely limited brand recognition and rough franchise management.

After closing the store, she posted on social media to complain about the brand: “The headquarters initially promised to provide various support, but the so-called operational strategies were just some low-cost activities, and they were completely indifferent to brand promotion.”

She used her painful lesson to warn “those who come after,” saying that choosing a mid-tier brand for a milk tea shop franchise is “the most dangerous,” advising to either choose the cheapest or a big brand.

What Liz didn’t know is that many entrepreneurs who joined first-tier brands also faced similar challenges.

Image source: Liz’s Xiaohongshu account

Bingbing joined a popular first-tier brand and opened three franchise stores consecutively from August last year. By October this year, she had accumulated losses of over 2 million yuan.

At the end of November, Bingbing revealed that she was about to close one of the stores. Due to various conflicts with the brand during operations, Bingbing also posted a series of complaints against them on social media.

Some Close Within a Month of Opening

Compared to franchisees and entrepreneurs who haven’t seen the full picture, second-hand equipment recyclers, known as “restaurant undertakers,” have witnessed many more tragic cases.

Liu, who runs a second-hand equipment recycling business in Chengdu, stated that after this year’s National Day, Chengdu’s milk tea shops experienced an extremely severe wave of closures. Many well-known franchise brands have become his “regular customers.” On the most dramatic day, he sent off five franchise stores of the same brand “on their last journey” in one go.

“No milk tea brand can escape the National Day curse,” Liu lamented.

Ah Fei, who operates a recycling business in Foshan, has been posting more recycling videos than sales on social media over the past six months. In mid-October, he recycled a batch of milk tea equipment from a shop in a mall in Foshan’s Chancheng district. The owner of this milk tea shop had purchased the entire set of equipment from him just over a month ago, and when he went to recycle it, the equipment was still 90% new.

“(The shop) closed in less than a month!” Ah Fei was very surprised; he didn’t expect this batch of equipment to be transferred to another owner so quickly.

Similarly, Xiao Wu, who is also in the business of recycling restaurant equipment, found that milk tea shops are no longer closing one by one but are shutting down in batches. Not long ago, he recycled equipment from three newly popular milk tea brand franchise stores in Changsha all at once. These three stores were all opened by the same franchisee, and according to Xiao Wu, their losses were in the millions.

It’s no exaggeration to say that the impact of milk tea shop closures has extended to the second-hand equipment recycling industry, and even the “restaurant undertakers” have started to face intense competition. As Liu said, “The equipment simply can’t be collected fast enough.” At the same time, because there is so much equipment waiting to be recycled, the “undertakers” are no longer accepting everything indiscriminately.

Guangzhou second-hand equipment trading market, photo by Red Restaurant Network

“We don’t even accept equipment from certain brands anymore. Even if we do, it’s hard to sell and can only be treated as scrap,” said Chao, who specializes in tea drink equipment recycling, to Red Restaurant Network. Like many of his peers, he now only accepts equipment that is “easy to sell.”

“To judge whether it’s easy to sell, usually you look at the overall momentum of the brand in the market and how many people are willing to open a store for it.” Chao Ge said.

Even Top Brands Are Struggling

It’s quite lamentable that when Li Zi, Wang Wangwang, and Bing Bing coincidentally shared their thoughts on closing stores on social media, the posts not only attracted fellow industry peers who were equally disgruntled and seeking solace but also a group of newcomers eager to learn about franchise fees or store-opening experiences, hoping to break into the milk tea industry.

Trapped in their information cocoons, they might not realize that the tea beverage market is turbulent, and it’s not just entrepreneurs facing operational difficulties; many top-tier brands are currently struggling to manage their own affairs.

According to public information, numerous tea beverage brands have experienced a wave of store closures over the past year, including several top-tier brands that have long stood at the pinnacle of the industry.

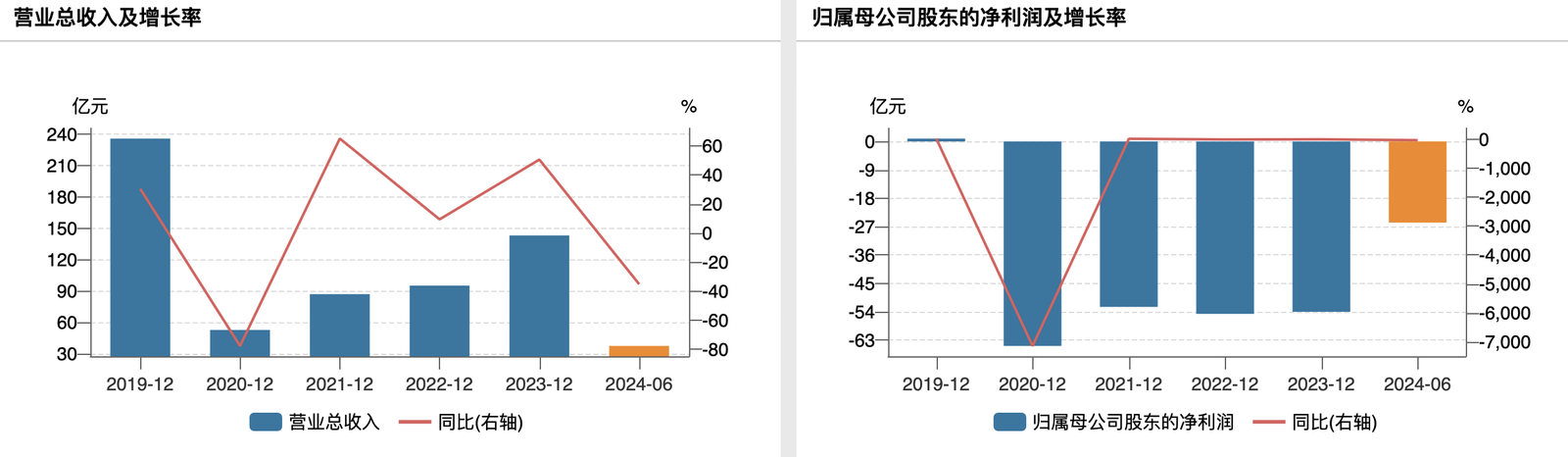

Cha Baidao, which officially went public this April, opened 826 new franchise stores in the first half of this year but also closed 245, equating to closing one store for every 3.37 new ones opened. Nayuki’s Tea, the “first stock of tea beverages,” shut down 89 directly-operated stores in the third quarter alone and completely closed all stores of its sub-brand “Tai Gai” at the beginning of the year.

Other unlisted tea beverage brands have not disclosed official data, but according to statistics from third-party agencies, several top-tier brands leading the industry in scale have closed far more stores than they have opened. One particularly struggling brand closed over a thousand stores, with significant losses in first-tier and new first-tier cities, which are battlegrounds for new tea beverages.

From a timeline perspective, the second and third quarters of this year were peak periods for top brands closing stores—at this time, the summer consumption peak in the south had not fully ended, yet a batch of poorly performing stores with no signs of improvement were already unsustainable and headed for closure, highlighting the immense operational pressure.

Besides the major brands, some once-popular internet-famous brands and regional chain brands have also suffered significant losses.

For example, “A Cup of Yogurt Cow,” known as the “Chongqing version of Tea Yanyue Se,” withdrew from 30 cities in the first half of the year. In 2022, A Cup of Yogurt Cow expanded rapidly beyond Chongqing, with the total number of stores once exceeding a thousand, but this year, its growth has visibly stalled.

Image source: Hongcan Network

The once somewhat famous brand, Fuxiaotao, has closed stores in multiple cities such as Hangzhou and Beijing since the beginning of this year, reducing its store count from a peak of over 230 to about 10. The first-generation internet-famous milk tea brand, Heilongtang, which once had over 2000 stores at its peak, now has only about 200 stores left, with an astonishing rate of closures.

Independent small shops have been closing one after another, and franchise and directly-operated stores of leading brands are also struggling. A large number of tea beverage industry practitioners are caught in a brutal survival game with no solution. This situation makes one wonder, how did the once thriving milk tea business fall to such a state?

Is the Price War “Killing Everything”?

The current predicament of the tea beverage industry is the result of multiple factors working together.

Firstly, in recent years, the tea beverage industry has entered a phase of accelerated expansion, with brands of all sizes rushing to stake their claims. At the same time, the pressure of workplace competition has driven many young people to leave their cubicles and join the milk tea entrepreneurship wave. Under the influence of these two forces, the number of tea beverage stores in the market skyrocketed in a short period until supply exceeded demand.

Public information shows that in just the first half of 2023, several leading brands proposed goals of having ten thousand stores, with many brands planning to add 3000+ new stores for the entire year.

Adding 3000 stores in a year means opening at least 8 stores per day on average. Each brand is striving to secure prime locations and quality franchisees. However, quality resources are limited, and the announced goals cannot be changed, so brands can only relax their standards: originally, only one store could be opened within a one-kilometer radius, but now it must be shortened to 500 meters because if you don’t take that spot, a competitor will. The requirement for franchise deposits can be lowered, and the experience of franchisees can be overlooked because if you don’t grant them franchise qualifications, they might turn to a competitor.

Lowering the entry threshold to accelerate store openings is inherently irresponsible to franchisees and lays the groundwork for future operational problems.

Secondly, due to oversupply and increasingly severe homogenization, store operation pressure has surged. Under heavy pressure, various brands have deviated from rational development paths, resorting to “price wars” and similar tactics, accelerating the depletion of store funds.

The proliferation of milk tea shops has led to increasingly similar flavors, which is the first impression for many milk tea enthusiasts. Severe product homogenization is a well-known pain point in the tea beverage industry, largely attributed to weakened brand product innovation capabilities and insufficient willingness to innovate, with strategies aligning everything towards efficiency and cost.

Recently, platforms like Xiaohongshu and Douyin have seen a trend of “DIY signature products from XX milk tea shops” at home. Popular products like Yidian Dian’s “Jasmine Milk Green” and Cha Bai Dao’s “Mudslide” are key targets for imitation. The popularity of DIY beverages among netizens indicates that the raw materials, formulas, and quality control of milk tea shops don’t have many secrets or barriers, making it difficult to create flavor differentiation, whether it’s this year’s popular light milk tea or classic fruit tea.

Image Source: Xiaohongshu

Without significant flavor differentiation, consumer loyalty is hard to establish. At this point, major brands can only think of the most traditional, simple, and seemingly effective competitive method: price reduction.

Statistics show that since 2021, the average customer price of nearly 30 domestic chain milk tea brands has declined, with only Mixue Bingcheng, which had already reached rock-bottom prices, as an exception among the leading brands. Among high-end market representatives, Nayuki and Heytea saw their average customer prices drop by 10.7 yuan and 10.4 yuan respectively over three years, far ahead of their peers. Even brands like Coco and Shuyi Grass Jelly, which target the mid-to-low-end market, are further lowering their prices.

Since the beginning of this year, the price war in the new tea beverage market has intensified. A product combined with various promotional discounts is priced directly under 10 yuan, becoming a regular practice for mid-tier brands, with more and more brands approaching the sub-10 yuan price range where Mixue Bingcheng operates.

Engaging in a price war might boost customer traffic and order volume in the short term, but it will inevitably hurt profits and, to some extent, transfer competitive pressure to the grassroots employees and franchisees.

This brings us to the third issue: the severe internal competition among leading brands and the proactive initiation of price wars, which accelerate the erosion of the survival space for independent small shops.

In first-tier and new first-tier cities, the tea beverage industry is highly chain-oriented, and independent milk tea shops that have been operating for many years are extremely rare. However, during the previous expansion period, a large number of brands aggressively expanded into county towns and even rural areas, taking away the business of many local individual shops.

Under the strong offensive of first-tier brands, individual shops lack brand recognition and marketing capabilities. With similar tastes and price points, it is naturally difficult to compete for business against first-tier brands. Coupled with limited financial strength, most small shops find it hard to escape being squeezed out.

The large-scale opening of new stores leads to market oversupply, and the obsession with low-price competition drags down the entire industry’s profits. In the era of stock competition, big brands ruthlessly squeeze small shops… One link after another, pressure builds layer upon layer, forming an unsolvable vicious cycle where the gears of fate drag almost all players into this zero-sum game with no winners.

Now, in just one year, nearly 200,000 milk tea shops have headed towards a dead end, and the entire industry faces an incredibly severe test. Industry practitioners have reached a point where they must let go of their obsession with growth and seriously contemplate the path forward.

Can the Tea Beverage Industry Resurge?

If we take the explosive popularity of Heytea in 2017 as a dividing line, the new-style tea beverage industry has been racing forward for a full seven years. During these seven years, the number of milk tea shops and consumers has experienced exponential growth, which clearly cannot be sustained indefinitely, and a slowdown is inevitable.

Of course, a slowdown in growth does not mean that the milk tea industry has completely lost its growth potential. According to a research report by Wanlian Securities, by 2027, the market size of domestic freshly made milk tea is expected to reach 511.8 billion yuan, with an average annual compound growth rate of about 19% from 2023 to 2027. Although the growth rate is not as high as during the peak period, there is still some potential to be tapped.

Slowing down means that the rules of the game have changed significantly. Big brands can no longer rely on the strategy of trading losses for scale, and entrepreneurs must realize that the golden age of tea beverages is over. Regardless of who you are, to survive, you must adapt to these changes and adjust your business strategies accordingly.

First, bid farewell to reckless growth and return to a path of rational management. Stable development is the key.

As one of the industry leaders, Heytea has taken the lead in changing its strategy. In mid-September this year, Heytea announced its withdrawal from the price war, stating it would “not produce homogeneous products or engage in pure low-price competition,” and would explore more differentiated products and categories. At the same time, it shifted its store growth focus from scale to quality, adjusted its franchise policies, strictly controlled the speed and number of store openings, tightly managed store density, and genuinely improved the quality of new store openings and the operational quality of existing stores.

Each brand’s situation is different. Brands that are currently thriving and have a low closure rate can naturally maintain a reasonable pace of store expansion and expand in an orderly manner. However, for brands that are simultaneously opening and closing stores, it is time to pause, refine the store model, and manage existing franchisees well, rather than continuing to open stores blindly.

It is worth mentioning that in the franchisee management phase, the “Matthew Effect” is expected to become increasingly evident. High-quality franchisees with strong capabilities will accelerate their aggregation towards leading brands, gradually nurturing a batch of large regional franchisees or franchise companies, leaving fewer resources for ordinary entrepreneurs.

Secondly, price wars only address the symptoms and not the root cause. No brand can sustain them in the long term. To retain consumers, it is essential to return to the core aspect: the product.

Although no single beverage can gain universal approval, since the rise of the freshly made tea beverage industry, many nationwide bestsellers have emerged: Heytea’s “Cheese Grape” almost single-handedly popularized the fruit tea category, Nayuki opened up a trend of incorporating niche fruits into ingredients with its “Dominant Pomelo,” and BaWangChaJi sold 600 million cups of its “BoYa JueXian”… These bestsellers are the core vitality and competitiveness of the milk tea industry, compelling consumers to willingly spend money.

As mentioned earlier, with tastes converging and each brand’s products losing distinctiveness, customers are rapidly dispersing, leading to a vicious cycle with the ensuing price wars, which is not beneficial for brands or consumers. Only by returning to the product itself and striving to develop products that better match consumer tastes and have more brand characteristics can this deadlock be broken. Heytea, which previously announced its withdrawal from low-price competition, may have regained its confidence from the new bestseller—the “Slimming Bottle” plant tea series, which sold over 10 million cups within a month and a half of its launch.

Thirdly, entering the stage of stock competition, the market tests the comprehensive strength of a brand: not only product development, brand operation, and franchisee management capabilities but also the underlying supply chain, logistics, etc., all become crucial to winning. This requires brands to diligently hone their internal skills and strengthen their weaknesses.

For example, to enhance management efficiency, some brands are keeping pace with the times by focusing on the AI sector. Recently, Mixue Bingcheng invested in the establishment of Xuewang AI Technology (Zhengzhou) Co., Ltd., which focuses on the development of basic artificial intelligence software and other businesses. Earlier this year, Mixue Bingcheng also established a smart supply chain subsidiary to explore the use of AI technology to improve supply chain and warehouse management efficiency.

Finally, since the dilemma of intense competition cannot be completely alleviated in the short term, it is expected that more and more brands will seek new growth opportunities overseas to ease the pressure.

Take Bawang Chaji as an example. Although rumors of its IPO in the U.S. have not been confirmed, it has already opened the door to America in another way. According to public reports, Bawang Chaji plans to enter the U.S. market in the spring of 2025, with the first batch of stores to be located in Irvine and Los Angeles, California.

Earlier, a large number of leading brands had already formed groups to venture into Europe, Southeast Asia, and other regions. Especially Southeast Asia, which has become a battleground that everyone must fight for: Mixue Bingcheng opened its first directly-operated store in Vietnam as early as 2018 and has now become a sizable chain milk tea brand in Southeast Asia; Heytea also chose Southeast Asia as its first overseas destination, opening its first overseas store in Singapore in 2018; Nayuki made a high-profile entry into Thailand last December, with its first directly-operated store located in Bangkok.

Compared to the domestic market, the overseas freshly-made tea beverage market started late and lacks influential local brands, leaving a lot of growth potential to be tapped. Taking Southeast Asia, the current focus of milk tea brands, as an example, according to a report by Huatai Securities, the GMV of freshly-made tea beverages in the region is about $6.3 billion in 2023, accounting for only about one-third of the freshly-made beverage market, with significant room for growth. It is expected that the compound annual growth rate will exceed 20% in the next five years. Considering factors such as climate and geography, Southeast Asia has long summers and hot weather, providing almost all the positive factors needed for a milk tea consumption market.

In summary, the world is vast, and there are still many places suitable for selling milk tea. Venturing abroad is certainly not a guaranteed profit; differences in local food culture and policies, as well as supply chain management, are challenges that need to be addressed. However, compared to blindly competing domestically, actively exploring more new growth possibilities undoubtedly aligns more with the long-term interests of both the brand and the industry.

After speaking out and regaining attention in front of the camera, Xie seems to be gradually regaining her former confidence and has begun to deeply reflect on her failures. When reviewing this nightmarish entrepreneurial experience, Xie repeatedly mentioned the keyword “blind confidence”: spending heavily on marketing and advertising to gain recognition; refusing capital involvement while expanding on a large scale; not stopping in time when store revenue began to decline, but instead spending more money on upgrades; being obsessed with opening large stores……

When making this series of decisions, Xie believed that the growth of the milk tea industry would continue, but she did not expect reality to deliver such a swift blow. The failure of Xie Yao and Yuan Zhenzhen is certainly not an isolated case.

Entrepreneurial novices who invested all their assets to open and then close stores, franchisees who fought fiercely for franchise rights only to quickly cease operations to cut losses, and leading brands that expanded crazily only to close stores in batches, all more or less fell victim to this blind confidence and incorrect estimation of industry development trends.

Looking back at the present, there are still newcomers eager to enter the milk tea industry—even though everyone knows that this track has long become a fiercely competitive red ocean, they still want to give it a try and seize the profits that may no longer exist.

It is undeniable that the food and beverage industry is one of the sectors with lower barriers to entry, and tea drinks are the easiest entry point within this sector. It will undoubtedly continue to attract many “corporate slaves” looking to escape work pressure. However, with so many painful experiences in the past, any novice wanting to join the milk tea army must ponder: At any time, opening a tea drink shop is not a guaranteed profitable business, and making money will only become increasingly difficult in the future. If you are not prepared, do not enter blindly.