Text | Qingcheng Finance

Chinese batteries are killing crazy.

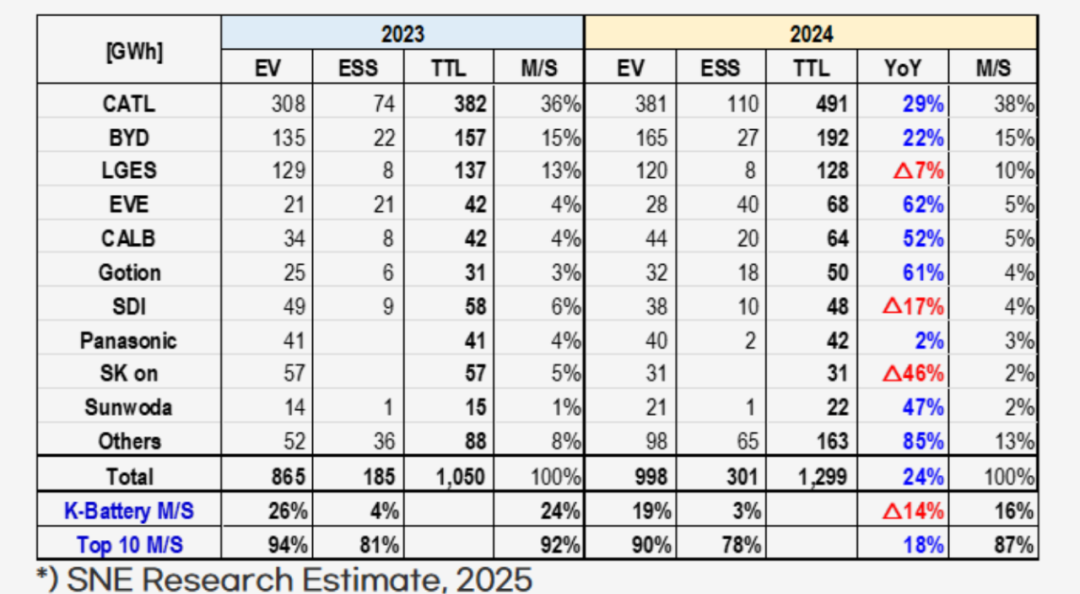

Recently, Korean research institution SNE Research released the 2024 power and energy storage battery shipment ranking list, an important signal appeared-Whether it is power batteries or energy storage batteries, Chinese companies are far ahead.Among the top 10 rankings, the original pattern of “Three Kingdoms Killing” between China, Japan and South Korea has become six Chinese companies that crush the entire market with a total market share of 69%. Three Korean companies barely survived with a market share of 16%, while only one Japanese company with a market share of 3% Panasonic survived.

*Photo source SNE Research

What’s even more powerful is that the market share of power and energy storage batteries of CATL, the largest brother on the list, reached 38%. Together with the second boss on the list, BYD, the total market share of the two companies is as high as 53%, and half of the world’s battery supply is in the hands of two king-level companies.

Batteries are the hard currency of the current global industry. From new energy vehicles to energy storage, from robots to aerospace, almost no emerging industry can leave the power of batteries.In the field of power batteries alone, CATL has been ranked first in the world for eight consecutive years, and its market share is getting higher and higher.

Once upon a time, it was not without overseas interest groups who wanted to get rid of the dominance of China’s batteries, but without the industrial foundation, they could not cook without rice.What Chinese companies won is not this battery, but the entire ecosystem behind it.

“Support global new energy”

In the battery industry, the largest use is the power batteries of new energy vehicles.New energy vehicles were once the loudest shouts in Europe. However, in the past two years, Europe has been continuously reducing the goals it has set. Behind the scenes, not only are the competitiveness of European car companies such as Volkswagen weakening, but also the failure of European battery supply links.

In an analysis at the end of last year, Bloomberg listed the “death list” of the European battery industry: Freyr in Norway has suspended battery production, and Northvolt, a former star in Sweden and a company supported by all Europe, has entered bankruptcy proceedings. Western Europe, British Volt filed for bankruptcy protection, France’s Verkor’s technical route was wrong, and it was one generation behind when it was put into production.

The French ACC suspends the construction of factories in Germany and Italy. In southern Europe, Italy Italvolt was rumored to be “on the brink of collapse”.

*Photo source Bloomberg

16 European-led battery factories, 11 have been postponed or cancelled. The plan to carry the sedan for the new energy generation of European automobiles has failed.Some media said: Only Chinese power batteries can save Europe’s increasingly collapsed automobile industry.After all, European companies can’t even make the list at the beginning of their articles. Even Japanese and Korean companies that have been infiltrated are in a worse and worse situation.

Japanese companies once had a deep chemical foundation, but Panasonic, which represents Japanese power batteries, fell 18% compared with 2023, and Japan’s name is being erased bit by bit from the power batteries. Now it is completely behind; LG Energy, SK On and Samsung SDI form the Korean power battery army, but the only LG that can compete with China is actually because it relied on the big tree of Tesla early and got the order; Samsung SDI is mainly used for BMW, but it is hard to support it.

In contrast, Chinese companies, while producing batteries, BYD exports cars to Asian and European markets, and simultaneously brings batteries to overseas. CATL’s customers not only include domestic automakers such as Zekr, Wenjie, and Ideal, but also won orders from most giants such as Tesla, BMW, Mercedes-Benz, and Volkswagen around the world. Last year, CATL increased by 31.7% on the basis of occupying nearly 40% of the global market.In 2024, CATL’s revenue is expected to exceed 356 billion yuan and profits are expected to exceed 49 billion yuan.

However, the most dazzling thing is not the growth of performance.Instead, leading companies such as CATL have completely raised China’s position in the technology chain.CATL developed the LRS (Licence Royalty Service) technology licensing model, collecting patent fees and service fees by itself, and handing over the factory to another manufacturer. This scene is very similar to the foreign companies collecting patent fees and China’s heavy asset business back then. However, today is the home court of Chinese companies.

In December last year, CATL and European Stellantis jointly expanded production, which was equivalent to further tied European car companies to their own tanks. In addition to CATL, Guoxuan Hi-Tech, which saw shipments increase by 61% last year, also announced a joint venture with Slovakian local battery manufacturer InoBat and received national financial support from the Slovak government.Europe has already “received” the dominant position of Chinese battery companies.

“Energy storage comes out of the second spring”

Power batteries are one, energy storage batteries are the second.In 2024, Chinese battery companies’ share in the energy storage field will show a stronger crushing attitude. The combined shipments of Japanese and Korean companies in the top ten are only one-tenth of that of Chinese companies. CATL once again ranked first in the global energy storage battery market with a shipment of 110GWh, accounting for 37% of the market. Yiwei Lithium Energy’s energy storage battery shipments exceeded BYD, achieving an astonishing growth rate of 90%.

*Photo source energy storage and power market

Although the rankings have changed, competition is still the home court of Chinese companies. A very important reason is that although the industry is divided into two tracks: power battery and energy storage battery, it is essentially a replica of the dividends of battery technology. In addition, the energy storage business is mainly for Party A to perform, and Party A’s needs need to be fully considered, which gives Chinese companies with advantages in technology and experience, a huge opportunity.

For example, in 2024, CATL launched the “Tianheng Energy Storage System”, which has a feature: it optimizes thermal management for the high-temperature environment of the desert and adapts to the extreme climate in the Middle East. As a result, it became CATL’s “trump card” for bidding for Saudi Arabia’s 23.3GWh Phase III project. In January this year, CATL won the UAE RTC project with a 19GWh energy storage system. Among the world’s first large-scale “all-weather” photovoltaic energy storage gigabit project, CATL supplies battery energy storage systems (BESS), Jinko Solar and Jinko Solar are the preferred suppliers of solar photovoltaic (PV) components, and China Power Construction Group is one of the preferred engineering, procurement and construction (EPC) contractors. It can be said that it is a complete Chinese team and also reflects Chinese companies such as CATL.All-round advantages in the energy field.

Another case is BYD. Although it seems that Yiwei Lithium Energy’s position on the ranking last year was surpassed by Yiwei Lithium Energy, this is actually because Yiwei Lithium Energy’s growth rate last year was extremely fast and BYD’s own industry status has not been weakened.

In February this year, BYD and Saudi Electric Power Company (SEC) signed a 12.5GWh grid-side energy storage project, becoming the world’s largest single energy storage order. Technology has once again become the highlight of this project. It adopts BYD’s new generation “MC Cube-T Rubik’s Cube System” and integrates CTS (battery cell direct to system) technology. The volume utilization rate is increased by 33%, and the single system capacity reaches 6.432MWh.

In addition, the first phase of the project that BYD previously cooperated with the SEC also fully demonstrated its grasp of customer needs: the first phase is located in the border area of southern Saudi Arabia, with the highest temperature in summer may reach 50℃ and there is a risk of sandstorms. BYD has completely conquered Saudi customers through environmental simulation, battery compartment design, additional sand prevention measures, etc.

*Photo source Saudi local news The picture on the right is the first phase of the project delivered by BYD

What few people know is that although BYD is currently famous for its status as the king of new energy, BYD Chairman Wang Chuanfu actually identified three major business segments in new energy vehicles, energy storage and photovoltaics as early as 2008. So far, BYD’s energy storage projects have been delivered more than 350 worldwide. BYD has had successful cases in 2011 in regional markets such as the United States that the industry is competing for.

“Create the “Chinese field” of the battery world”

The Chinese power represented by CATL and BYD has undoubtedly created an unbreakable “Chinese field” in the battery industry. The more important the energy topic is, the more meaningful the barriers they build.

Their success is first of all thanks to large-scale engineering and application experience within the Chinese market. For example, in 2024, BYD sold more than 4.25 million new energy passenger cars, ranking first in the world. BYD’s own business is the best verifier of its battery level. In terms of overseas layout, as a leading enterprise, CATL has fully deployed production capacity in the domestic market, and has also been in Germany, Hungary, the United States, Indonesia, Thailand, Spain, Morocco and other places.A total of 9 overseas battery production projects have been invested and built to meet the needs of overseas customers for nearby supporting facilities.

Saturated competition within the Chinese market also brings obvious price advantages. Bloomberg NEF’s “2024 Electric Vehicle Outlook” points out thatIn the field of new energy vehicles, the global price of lithium iron phosphate battery cells is as high as US$95/kWh, while the price of this type of battery cells in China is only US$53/kWh.

Secondly, it comes from long-term focus on technology research and development, continuous breaking overseas patent monopoly, and even building its own unique moat. In 2020, BYD released blade batteries, and achieved a surge in performance by 2023. The technological explosion helped BYD build differentiated advantages in the new energy vehicle industry, promote sales growth, and then have more resources to invest in R&D. From 2020 to 2024, the proportion of lithium iron phosphate batteries in China’s power battery market increased from 38% to 75%. The technical advantages of ternary lithium batteries that overseas companies have previously mastered have gradually disappeared. Count the innovations of domestic battery companies, including CATL’s Shenxing Battery, Zekrish Gold Brick Battery, Honeycomb Short Knife Battery, Xinwangda Xinxingchi Battery, allEach has its own strengths in fast charging, safety, etc., which is a feature that neither European, American, Japanese and Korean battery companies have.

Third, it is leading in the field of power batteries and energy storage batteries. CATL’s business model is far better than that of overseas battery companies that lack market foundation. Similar examples are precisely that companies such as BYD and CATL can expand all the way in the Middle East market, and after completing the first phase, the second phase, and after completing the construction of this one, the next one is built. In the cooperation between CATL and Stellantis, Stellantis directly stated that it hopes to enhance the advanced advantages of lithium iron phosphate batteries in Europe and create a more cost-effective and durable car. In other words, after having an advantage, Chinese companies can snowball. The window of opportunity for European and American companies that were insufficient in their early years, as well as Japanese and Korean companies that fell behind in development will only get smaller and smaller.

Especially at present, the industry’s progress will not stop. BYD has been researching technologies such as solid-state batteries that may bring about industry revolution since 2013. CATL has expanded its team in this field from 100 people to 1,000 people last year. China’s battery patent technology accumulation has long been far ahead and has the richest application scenarios. After one step of success, it has already gained the advantage of being difficult to see the back overseas.

mainstream companies such as CATL, BYD, Guoxuan Hi-Tech, and China Innovation Airlines have made it clear that they will start loading vehicles this year for new technology verification and start small-scale production in the next two years. The gap overseas will only widen.Companies led by CATL and BYD will continue to shape an unbreakable alliance between China’s batteries.

For more exciting content, follow Titanium Media WeChat account (ID: taimeiti), or download Titanium Media App