Text | Digital Reading of Smart Cars

At the launch conference of MONA M03, He Xiaopeng created another anxiety: “In the next ten years, there will only be seven mainstream car companies left.”

August is the disclosure period for semi-annual reports. In addition to sales, financial status has become the focus of public attention.

Xiaomi disclosed its automotive business performance, and the topic of losing 60,000 per car became a hot search; at the end of the month, facing the rumor that “NIO announced bankruptcy”, NIO directly announced to call the police. The reason why the rumor came to NIO was that from 2018 to 2023, NIO had already lost a terrifying 72.9 billion.

While continuing to increase sales, the sustainability of car companies’ operations is also a top priority. Only when they survive can they consider the possibility of becoming mainstream.

Sales continue to rise

Policies continue to add fuel to the new energy market.

On August 16, the Ministry of Commerce and seven other departments issued the “Notice on Further Improving the Work of Auto Trade-in”. For individual consumers who scrap old cars and buy new cars in accordance with regulations, the subsidy standard for purchasing new energy passenger cars will be increased from 10,000 yuan to 20,000 yuan.

Officials said that they will promote low-carbon transportation and make new energy vehicles the mainstream of new sales vehicles by 2035.

The incentives have helped boost the overall sales of new energy vehicle companies to continue to rise.

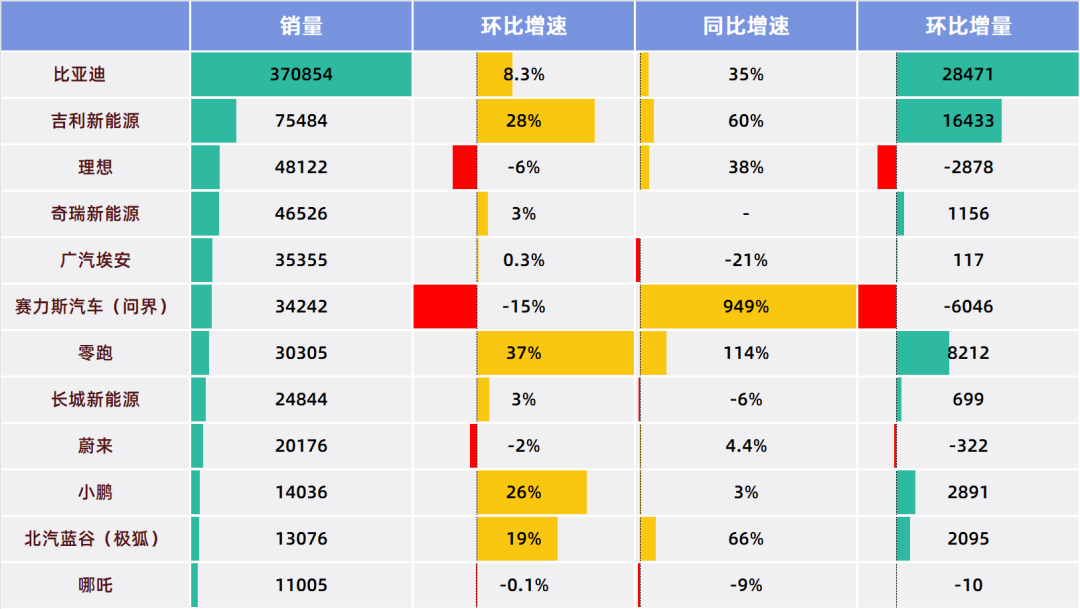

After a relatively flat July, auto sales climbed again in August. So far, 12 automakers and 22 brands have released sales data. Among the automakers, only Aion, Nezha, and Great Wall saw a year-on-year decline in sales. Only four saw a month-on-month decline, including Ideal, which hit a record high last month. Among the 22 brands, 15 saw month-on-month growth.

The average sales volume of 22 brands was 31,030 units, an increase of 2,206 units from July. The median sales volume was 16,026 units, an increase of 2,626 units from July. Overall, the sales performance in August was much better than that in July.

Compared with July, the threshold for car companies has been raised. Faced with more brutal competition, manufacturers will not stop their internal competition. At the end of July, many car companies expressed opposition to the weekly sales list of new energy vehicles, but this did not prevent Ideal from releasing the weekly sales list. This market is like sailing against the current. Take Nezha Auto as an example. Because Nezha has almost stagnated in the past three months, it has dropped from the second to last to the last among the 12 manufacturers.

If only seven automakers can become mainstream, then nowadays, monthly sales must reach at least 30,000 units before there is a chance to discuss this issue. This is under the premise that Xiaomi, SAIC, Dongfeng and other automakers have not yet announced specific monthly sales data.

Whether to be competitive or not is not something a company can choose. Yu Chengdong said when launching the new M7 Pro of Q7 Pro that the car loses nearly 30,000 yuan on each sale. If this is the case for the high-end Q7, one can imagine the situation for other car companies.

Sales volume may mean losses, and no sales volume means there is no chance to achieve economies of scale and reduce costs.

Half-year indicators are expected to

At present, the market is still open, users’ acceptance of brands is not low, and new brands have the potential to see a significant increase in sales.

In August, BYD, Geely, Chery, and Leapmotor all achieved record sales. Specifically speaking, in addition to very strong brands such as BYD, many brands that were not outstanding before also achieved breakthroughs.

Leapmotor was originally only in the second tier among the new forces, but this month its sales soared to over 30,000 units, setting a new historical high.

Geely Galaxy released its fourth model this month. Originally, the Galaxy brand was not the main force in Geely’s sales, but this month Galaxy’s market performance was outstanding, becoming Geely’s best-selling brand and helping Geely’s new energy sales hit a record high.

The sales volume of Changan Shenlan had always been difficult to break through 20,000 units, but in August, Shenlan also reached a new level, reaching 20,131 units.

It can be seen from this that the new energy vehicle market has not yet reached the stage where the pattern has been determined, and there is still an opportunity for many car companies to break through.

With the release of the August report card, two-thirds of 2024 have passed. According to the goals set by automakers, the progress of seven automakers or brands is currently relatively optimistic.

Among them, BYD has completed 65% of its annual target, Zeekr has completed 61% of its target, and after lowering its target, Ideal has currently completed 60%. If everything goes well, it is almost certain that these three companies will achieve their annual targets.

In addition, Geely’s new energy vehicle sales have reached 57%, NIO and Leapmotor have both reached 56%, and BAIC BluePark has reached 52%. These four companies are also very likely to achieve their set goals.

However, Zhiji, Xiaopeng and Nezha are currently progressing slowly, with the target progress being less than 30%, and it is already very difficult to achieve the target.

New car releases

At the end of August, the Chengdu Auto Show opened. This is one of the important battlefields for auto companies every year. Many auto companies have scheduled the launch of new products in August.

On August 3, Geely Galaxy released its fourth model – the pure electric compact SUV Galaxy E5. This model may be the key reason for the increase in sales of the Galaxy series.

On August 5, Chery’s brand Xingtu released the 2025 medium and large SUV Lanyue. In this month, Chery also released a number of models intensively, including the medium-sized SUV Tiggo 8 L and the 2025 Xingtu Xingjiyuan ES. The intensive release of models also made Chery’s new energy delivery volume reach a new high.

On August 6, BAIC and Huawei jointly launched the flagship model of medium and large cars, Xiangjie S9. The price range of the two models is set at 399,800 to 449,800 yuan. Within 72 hours after the launch, the number of orders exceeded 4,800 units, and the number of orders currently exceeds 8,000 units. This performance is very impressive in the high-price segment.

On August 9, Dongfeng Motor’s Yipai eπ007 extended-range version was launched. In addition, Lantu’s MPV model Dreamer released its new model of the year.

On August 13, Nezha S Shooting Brake started pre-sale, with the pre-sale price of the extended-range version starting at 175,900 yuan.

On the same day, the 2025 Zeekr 001 and Zeekr 007 were launched simultaneously. In addition, Zeekr also released the large five-seater pure electric SUV Zeekr 7X, which is equipped with an 800V high-voltage platform as standard and has a starting price of 239,900 yuan. It is worth noting that the new Zeekr 001 and 007 are less than half a year away from the launch of the 2024 Zeekr 001 and only 8 months away from the launch of the 2024 Zeekr 007. Many car owners believe that “a new car becomes an old car in half a year” infringes on their rights and interests, and there have been incidents of blocking the delivery center. The incident was eventually settled, but the subsequent impact on Zeekr remains to be evaluated.

As a leader in new energy vehicle companies, BYD is looking forward to the U9 starting deliveries this month. BYD also released the 2025 Song PLUS EV, BYD Seal and Seal 07 DM-i.

On August 26, the new M7 Pro was officially released with a starting price of 249,800 yuan.

Changan Avita’s third model, Avita 07, has started pre-sale. During the Chengdu Auto Show, the deep blue S05 and L07 made their debut.

In addition, Great Wall Wei brand released the new Blue Mountain Intelligent Driving Edition model, and JIS 01 Standard Endurance Edition of JIS Auto was also launched this month.

With the release of a large number of new cars, car companies have made preparations for the second half of the year. According to the rules of previous years, the next four months will be the key to the sales sprint.

Enthusiasm for going overseas is high

Sales growth cannot be judged solely by the domestic market; automakers’ ambitions for overseas markets are very clear.

BYD expressed its optimism about Vietnam’s electric vehicle market, saying that the development process of this market has just begun and has huge development potential.

Haobo, a brand under GAC Aion, changed its English name to “HYPTEC” and launched a new brand color. Analysts believe that Haobo’s move is aimed at expanding the international market.

MG Automobile, a subsidiary of SAIC Motor, announced that it plans to build a Latin American hub in Mexico, including an automobile factory and a research and development center. The relevant person in charge said that this plan will not only realize localized production, but also explore the Latin American market.

In addition, Xiaomi Group President Lu Weibing said that Xiaomi Auto is studying to enter Europe. Zeekr Intelligent Technology Vice President Chen Yu said that Zeekr plans to enter the Japanese market in 2025.

Of course, going overseas is not an easy task at present. Even a strong company like BYD, which achieved record sales, only exported 30,451 units in August, which is still far from the previous peak.

In comparison, Great Wall, Geely and Chery performed positively, with Great Wall exporting 40,454 units and Geely exporting 45,045 units, both of which set new historical records and reached a new level. Chery’s export business was even more impressive, with sales reaching 97,866 units in August. However, compared with BYD, these three automakers export more than just new energy vehicles.

Seize Huawei’s Automotive BU

In addition to going overseas, timely filling in the gaps is also an option for car companies.

In the past two months, “Shenzhen Yinwang” has become a hot word in the automotive industry. This company is a new company established by Huawei’s automotive BU in January this year. As BAIC, Chery, JAC and Huawei’s automotive BU have reached in-depth cooperation, the “four circles” have been announced one after another. In the eyes of the outside world, Shenzhen Yinwang may be a smart car alliance system formed by many car companies.

According to data disclosed by Huawei, Shenzhen Yinwang’s operating income from 2022 to the first half of this year was 2.098 billion yuan, 4.7 billion yuan and 10.435 billion yuan respectively, with gross profit margins of 17.73%, 32.13% and 55.36% respectively, and net profits attributable to the parent company were -7.587 billion yuan, -5.597 billion yuan and 2.231 billion yuan respectively. It is estimated that the net profit attributable to the parent company in 2024 will be 3.351 billion yuan. The performance is very strong.

Against this backdrop, Shenzhen is expected to become a target for automakers.

On August 19, Changan Automobile announced that Avita Technology plans to purchase Huawei’s 10% stake in Yinwang for 11.5 billion yuan. This may not be the end, and Avita Technology may continue to choose to follow up. It is reported that “Avita may continue to increase its stake in Yinwang to 20%.”

After Avita, SERES, which was the first to choose the smart selection model, also chose to invest. On August 25, SERES issued an announcement, also for a 10% stake worth 11.5 billion yuan.

In addition, the latest news shows that Huawei is currently negotiating with car partners such as BAIC Blue Valley and JAC Motors. Of course, for a long period of time, Yinwang will still be led and managed by Huawei.

Car companies have been clinging to Huawei since the beginning of the year. With the help of Huawei’s intelligent driving system, car companies can quickly make up for their shortcomings. Now, by acquiring shares, car companies have further tied up with Huawei, which is equivalent to further strengthening the stability of cooperation and reducing risks.

Wei Xiaoling: Go all out to boost sales

Since last year, there has been a clear differentiation between NIO, Xiaopeng and Li Auto, with Ideal leading the pack and this is still the case this month. Since the second quarter of this year, NIO and Leapmotor have gradually entered the second echelon, while the sales of Xpeng and Nezha have been in a slump.

Leapmotor is the best performing automaker in the second echelon. August was the first full month of delivery for the C16, with over 8,000 units delivered, a very impressive performance. This helped Leapmotor create a new record of 30,305 units, reaching the 30,000 mark for the first time.

Leapmotor does not have many models. Its advantages lie in low-priced extended-range models, product strength, and a steady development strategy. Leapmotor has been increasing sales almost step by step, which is a very positive performance. However, Leapmotor does not have many cards to play. After all, the starting price has always been less than 200,000 yuan, and it is difficult to extend to a higher price segment.

Weilai’s sales began to climb in April and stabilized to a base of more than 20,000 units per month. It is worth noting that in May this year, Weilai’s Ledao brand was officially launched, and the first model Ledao L60 began to be delivered in September. In other words, when the low-priced models have not yet been delivered, Weilai has stabilized to 20,000 units. Among them, the basic ability of battery swapping is the key factor.

At present, Ledao has opened more than 100 stores simultaneously, covering 55 cities across the country. There is a high probability that NIO’s sales will reach a new level.

Xpeng Motors is in a similar situation to NIO, with sales climbing more slowly and still not exceeding 15,000 units so far this year. However, Xpeng Motors’ low-priced models have also been launched on the market. On August 27, Xpeng MONA M03 was released, and nationwide deliveries officially started at the Chengdu Auto Show on August 30.

MONA is a high-volume model of Xiaopeng Motors, priced from 119,800 yuan. It provides high-end intelligent driving functions for models under 20, trying to open up the market with low prices and high configurations. The launch performance of MONA M03 was quite explosive. Within 48 hours after its launch, the large-volume sales exceeded 30,000 units, and the passenger flow on weekdays reached 1,300+, becoming a phenomenal product of 100,000 yuan. Compared with Ledao, which still sets the price at more than 200,000 yuan, MONA has already reduced the price to less than 200,000 yuan. Xiaopeng’s next sales performance is worth looking forward to.

There is no doubt that both NIO and Xpeng will have the opportunity to show extremely impressive sales levels in the next four months. However, whether it is Leapmotor, NIO, or Xpeng, while desperately trying to increase sales at this stage, operating pressure will be an unavoidable topic. The profitability of these three car companies is far away. In the first half of the year, Xpeng lost 2.65 billion yuan, Leapmotor lost 2.2 billion yuan, and NIO is unlikely to make a profit either, and the operating pressure is not small.

Ideal vs. Hongmeng: The winner is still unknown, but they will coexist for a long time

Hongmeng occupies the ecological niche of intelligent driving, and Ideal’s ecological niche is also unbreakable. The two companies are strong in high-end models. At the beginning of the year, Hongmeng briefly surpassed Ideal, but now the gap between Hongmeng and Ideal is getting bigger and bigger. This month, Hongmeng’s sales of the entire series are 33,699, while Ideal’s sales are 48,122, which is a difference of one Xiaopeng Motors.

At present, the models of Wenjie, Zhijie, Xiangjie and Zunjie have been finalized. Although Wenjie’s performance in August was not outstanding, the sales of M9 and M7 models have both exceeded 10,000, which shows that Huawei has a strong appeal in the high-end market. This is a testament to the strength of its brand, product and technology. In August, Wenjie’s new M7 Pro was released, and the number of pre-orders exceeded 6,000 within 48 hours of its launch. Its sales prospects are worth looking forward to.

The Xiangjie S9, a joint venture between Huawei and BAIC, sold 8,000 units in 20 days after its launch, and some deliveries have already begun in August.

The pure electric SUV Zhijie R7 jointly developed by Huawei and Chery has also been unveiled, with an estimated price range of 300,000 to 400,000 yuan.

In addition, the fourth member “Aojie” will also be released in the fourth quarter. Aojie has three large vehicles under development, covering three major categories of sedans, SUVs and MPVs. The first car is expected to be released in Q4 2024.

In terms of price segment, the “Four Realms” are direct competitors with BBA, Ideal, etc. Ideal said at the earnings conference, “Hongmeng Zhixing is our strongest competitor in the market, and we will coexist healthily for a long time.”

Hongmeng and Ideal will be the objects of comparison for a long time.

Great Wall Motors: A precarious situation

In terms of sales, Great Wall’s predicament has become very obvious.

Since the beginning of this year, the sales volume of Great Wall New Energy has never exceeded 30,000 units again, and it has almost remained stagnant. In August, the sales volume of Great Wall New Energy was 24,844 units, which is not a bad performance, but it also showed a year-on-year decline.

The bigger problem for Great Wall is that it lacks a leading brand in the new energy sector. Its subsidiary, Ora, delivered 5,151 units this month, and has not even broken through 7,000 units in the past eight months of this year. Wei brand is even bleaker, with sales of 3,001 units in August, and has always been in a tepid state.

What’s more troublesome is that in August, Great Wall Motors was “blacklisted” by China Southern Power Grid and received a regulatory work letter from the Shanghai Stock Exchange. On August 14, China Southern Power Grid issued a supplier handling announcement stating that Great Wall Motor Co., Ltd. was listed as a “non-bid” supplier due to “significant breach of trust by the supplier and adverse impact” and the handling period is 24 months. It can be said that when it rains, it rains. Great Wall’s development is undervalued.

At this stage, with the layout of new energy encountering obstacles, Great Wall is eagerly looking forward to Wei Jianjun to turn the tide.

BAIC: Go big

Just like Chery, which cooperated with Huawei a few months ago, BAIC is now eager to try.

In August, BAIC BluePark sold 13,076 units, which seems average, but this is the first time in such a long time that BAIC has achieved consecutive deliveries of over 10,000 units.

BAIC has launched many new cars this month. On August 1, Arcfox added an entry-level model, the S5 560 Pro, to the Alfa S5 model, with a guide price of 160,800 yuan. This is an attempt to lower the entry threshold of the entire car series and enhance its market competitiveness. In addition, the Enjoy S9 was also launched.

After a long period of downturn, BAIC has begun to take intensive actions. Its sales are likely to see a new upsurge, and it will have the opportunity to become an important disruptor in the future.

In August, domestic new energy vehicle companies started a new round of product launches, intensively releasing models, strengthening cooperation to make up for shortcomings, and preparing for the sales sprint in the next few months. Although the “involution” of car companies will not last forever, in the environment of sailing against the current, such a choice is still difficult to reverse in the short term.

For more exciting content, follow Titanium Media WeChat ID: taimeiti, or download the Titanium Media App