Text | New knowledge in science and technology, author丨Fu Shen editor丨Fern Ying

Xpeng Motors finally got out of the “ICU”!

At the 2024 Paris International Auto Show not long ago, He Xiaopeng said in an interview with “Cover” that he was very grateful to Lei Jun for pointing out that he “just wants to be the chairman but not the CEO.” Xpeng Motors, which has emerged from the trough, and Xiaomi, together with Xiaomi, released the same performance report that was also called the “strongest in history” on the same day, November 19.

Xiaomi’s strongest strength mainly comes from the instant success of Xiaomi SU7. In the financial report, the revenue from innovative businesses such as smart electric vehicles is listed separately for the first time, reaching RMB 9.7 billion. Xpeng’s strongest success comes from the sub-brand product MONA M03 and the newly launched P7+, which has swept away the two-year-long haze of falling behind since the G9 crisis.

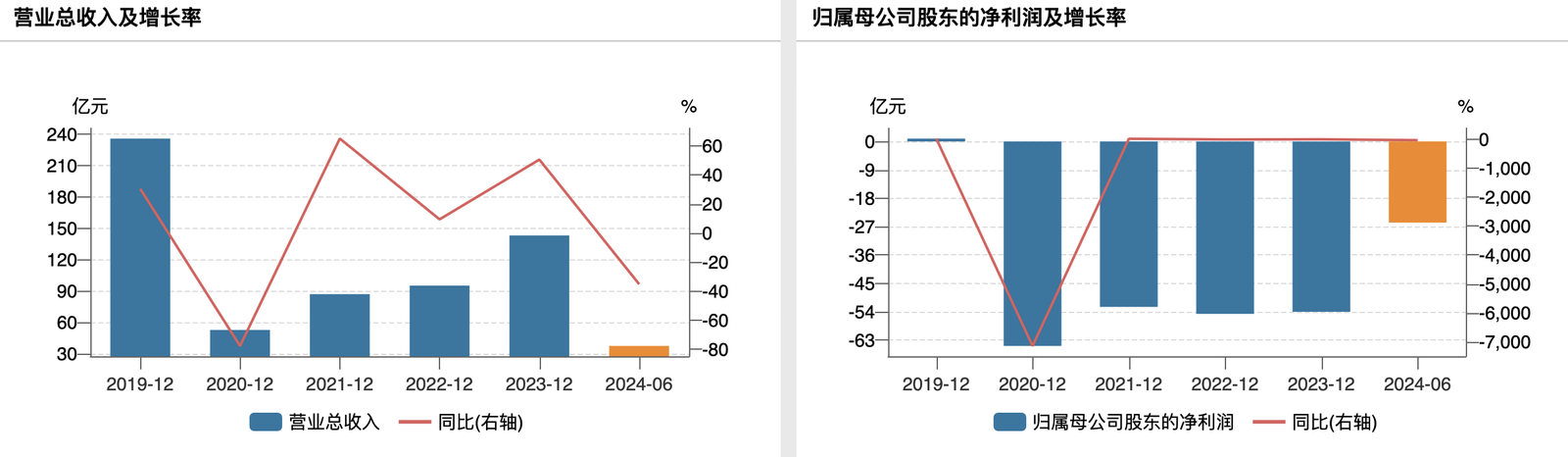

However, Lei Jun helped He Xiaopeng return to the forefront of new car-making forces, but it cannot solve Xiaomi Auto’s loss problem in the short term. Xpeng Motors’ revenue and delivery scale hit new highs, and it is an indisputable fact that it lost nearly 4.5 billion in the first three quarters.

The standardized automobile industry is a representative business model that uses scale to create profits. The fledgling Xiaomi Motors, with its traditional mobile phone business on one side, can still gain some patience from the capital market. But Xpeng Motors, which has been established for ten years, is now facing a more intense second-half competition of new energy vehicles after going back and forth before the gate of death.

What’s more, the external appearance of rebounding from troughs and returning to glory is often the same. Regarding the return of Xpeng Motors to its high glory, some people say that it is a strong comeback and it has found the password to become a hot product, while others say that it is bowing to reality and just moved from the ICU to a general ward. The most critical thing is not to summarize the secret of his return to the team from the strongest financial report, but to discover the solution to the future.

Low price for hot model

At the Xiaomi SU7 launch conference, Wei Xiaoli, the founders of three new forces, all came to the scene to collect firewood for Lei Jun. Unlike the high-spirited Li Xiang, He Xiaopeng and Li Bin listened to the speech and secretly took notes in their hearts.

The ultimate cost-effectiveness that once dominated the mobile phone market has been proven by Xiaomi SU7 to be equally effective when put into new energy vehicles. Xiaopeng’s MONA and NIO’s Ledao came into being.

At the Xiaopeng MONA press conference, the moment the price was announced, Lei Jun happened to be raising a glass to drink water among the cheering crowd in the audience. The unusual silence may be a sign of relief, or it may be a threat.

The MONA M03, with a starting price as low as about 100,000 yuan, has made the market unanimously believe that Xiaopeng has made the “Redmi Car” that Lei Jun did not build.

What is even less likely to be a coincidence is that according to a third-party agency survey, the main customer profile of Xpeng MONA M03 is consumers in the age group of 22 to 40. Among them, female customers are particularly fond of Xinghanmi’s color matching. Lei Jun previously mentioned at Xiaomi’s internal sharing meeting that nearly 30% of Xiaomi SU7 car owners are female users. In fact, among car owners who drive SU7, female users are estimated to account for 40%-50%. .

With overlapping target customer groups and a 50% off starting price, MONA M03 almost perfectly replicates the success of Xiaomi SU7 and can be called a comeback for Xpeng Motors.

52 minutes after the launch, the number of large-scale orders exceeded 10,000; 48 hours after the launch, the number of large-scale orders exceeded 30,000 units. He Xiaopeng personally gave afternoon tea to employees to celebrate, and the cumulative increase in the secondary market in 10 trading days was close to 20%.

Xpeng Motors has launched low-priced models. The first mass-produced model, the G3, set the price range starting at 150,000 yuan, and it even became the standard for online ride-hailing in some parts of the country. However, as an early new energy model, its slightly weak product strength was quickly overwhelmed by lower-priced products such as Nezha and Wuling Hongguang.

The popularity of Xiaomi SU7 and MOMA M03 is not based on absolute low prices, but on product configurations that surpass the same level. Xpeng P7+ orders exceeded 31,528 units within 3 hours of its launch, setting a new record, which also confirms this point. The starting price of 186,800 yuan is much lower than market expectations. Compared with the P7’s starting price of 229,900 yuan after subsidies, it is full of sincerity. Coupled with the high-end smart driving that is standard in the entire series, it is simply a price reduction. Big gift package.

Continuously pursuing hot sales at low prices will inevitably bring about financial losses. However, Xpeng Motors’ gross profit performance in its latest financial report did not fall but rose. In fact, this is related to the strategic cooperation won by the Volkswagen Group earlier this year. Software and technical service fees do not bear the hardware cost. Reflected in the financial report, the third quarter service and other revenue was 1.31 billion yuan, an increase of 90.7% from 690 million yuan in the same period of 2023; the third quarter service and other profit margin was 60.1%, which was 36.1% higher than the same period in 2023. Significantly improved.

Behind the simple and crude price war, there is actually the art of balancing configuration and pricing.

Admit failure and change route

Xpeng Motors, which has saved the revenue and sales crisis, not only humbly learned from the latecomer Xiaomi, but also slapped its former self in the face.

In 2020, Xpeng Motors made a strong official announcement that future models will use lidar to improve smart driving performance, not wanting to attract Musk’s ridicule. The latter tweeted that Xpeng Motors had copied old codes from Tesla and Apple, and that lidar was “only used by fools.” Naturally, He Xiaopeng couldn’t let others down. He posted an article saying that Musk was spreading rumors and threatening to “beat Tesla to nothing” in terms of domestic autonomous driving.

Line battles and wars of words are not uncommon in the tech world. Subsequently, Tesla’s FSD (Full Self-Driving) service has not been fully implemented in the domestic market. Xpeng Motors has invested heavily in lidar smart driving and indeed remains at the forefront of the country, but it has suffered from product sales that have not been popularized.

The reversal occurred in June this year. He Xiaopeng personally went to the United States to experience the FSD of Tesla V12 and praised it highly. The FSD v12 launched by Tesla at the end of last year upgraded the smart driving stack on urban streets to a single end-to-end neural network, replacing the previous more than 300,000 lines of code rules. With the support of pure visual solutions, it can perform real-time Input images and output vehicle control signals such as steering, braking, and acceleration.

Ordinary cameras are cheaper than lidar, and the end-to-end perception and decision-making integrated smart driving solution is more anthropomorphic than traditional rule stacking. Tesla seems to have once again captured the future of autonomous driving.

One month after returning to China, some media revealed that Xpeng Motors’ new models will no longer use lidar, but will adopt a purely visual smart driving solution. Musk, who is extremely active on social platforms, immediately forwarded the message and replied with an ellipsis. The Xpeng P7+, finally released in October, won the title of “the world’s first AI car” and became Xpeng Motors’ first purely visual smart car model.

The changes in the smart driving route also extend to the power route.

On the Xpeng Technology Day on November 6, He Xiaopeng officially announced that it has entered the extended-range track and released the Xpeng Kunpeng super electric system. Although he has repeatedly stated that it is meaningless to make another ordinary range-extended vehicle. Kunpeng in the Kunpeng super electric system represents the range-extended system and adopts the next generation of range-extended technology. But the popularity of the extended-range market is probably the core reason why Xiaopeng is eager to “cross-border”.

“Technology New Knowledge” once believed in the article “Pure Electric, Extended Range, Plug-in Hybrid Three Kingdoms, Wei Xiaolimi starts the battle for the new king” that the extended range route is not only the secret to boost sales, but also a way to save the building from collapse. The magic weapon, the two new forces, Ling Pao and Nezha, came back from the dead, which is the best proof.

Xiaomi Motors will launch an extended-range model code-named “Kunlun”, and Xpeng Motors cannot fall behind again in the general trend of the industry.

Things have changed for friends and businessmen

What lies before He Xiaopeng, who has returned as CEO, is no longer the new energy vehicle market it once was. Wei Xiaoli, who was once the leader, is now showing obvious differentiation.

Ideal, the most profitable company, has achieved eight consecutive quarters of profitability, and its gross profit margin has returned to more than 20%. Quarterly delivery volume and quarterly revenue have both reached record highs, making it very likely that Ideal will lock in the delivery of new forces in 2024 in advance. Quantity champion.

In the third quarter of this year, Ideal realized total sales revenue of 42.9 billion yuan and net profit of 2.8 billion yuan. There is no trace of the impact of the MEGA crisis on the pure electric model in the first quarter. Xpeng Motors, which made similar mistakes with the G9, has been languishing for more than a year.

NIO, which insists on changing the power line, has endured continuous investment in the selection of technical routes, and its net loss in a single quarter continued to exceed 5 billion yuan. Fortunately, the stable monthly sales and record high delivery volume allowed Li Bin to make up his mind to reduce costs and increase gross profits.

Compared with the ups and downs of its old rivals, what Xpeng Motors deserves more vigilance about is actually a new strong competitor. On the delivery list where Ideal and Huawei top the list, Leappo has emerged as a dark horse, while Xiaomi has almost dominated the hot topics both inside and outside the industry.

Comparing the financial reports, we can find that Leapmotor’s revenue in the third quarter reached 9.86 billion yuan, a year-on-year increase of 74.3%; the net loss was only 690 million yuan, a year-on-year narrowing of 30.3%. During the same period, Xpeng’s strongest financial report in history was a record-high revenue of 10.1 billion yuan, a year-on-year increase of 18.4%, which did not exceed the former by a large margin; the net loss was 1.81 billion yuan, a year-on-year narrowing of 53.5%, but a month-on-month increase. The quarterly net loss was 1.28 billion yuan, an increase of 40.71%.

Although new car-making forces often talk about “losing money on one sale”, Xpeng Motors delivered 46,500 new cars in the third quarter. Compared with the 86,100 new cars delivered by Leapmotor in the same period, the sales were actually better. Lose less and lose more. The reason is also relatively obvious, which is the explanation often used by He Xiaopeng on the earnings call: too much investment in technology research and development. But will Xpeng, which changed its company name to “Xpeng AI Car Company” and launched the “AI car war”, be the one with the last laugh?

Currently, Tesla and Xpeng are indeed the only two car companies in the world that have achieved end-to-end mass production of large models. But Musk has also bluntly stated that his artificial intelligence company x.AI has the strongest AI training cluster in the world and has invested US$4 billion. This does not include the resulting increase in power consumption, heat dissipation, and inter-card communication. cost.

In addition to domestic peers such as Ideal and NIO, which are transforming end-to-end smart driving solutions, major Internet companies such as Baidu, Alibaba, and Huawei will not let go of their share of the smart driving market based on their more powerful basic large-model capabilities. In terms of perception on the consumer side, AI cars are similar to existing AI PCs and AI mobile phones. They are more like the icing on the cake in terms of product experience, far from reaching the level of revolutionary subversion.

The returning He Xiaopeng and Xiaopeng Motors, while betting on the future, must also be wary of friendly companies that have changed. In the future, whether He Xiaopeng can lead Xpeng Motors to have the last laugh on the AI car track depends not only on technological breakthroughs, but also on how to find its own position in the crowded market.

For more exciting content, follow Titanium Media’s WeChat account (ID: taimeiti), or download Titanium Media App