by Alpha Photo

SoftBank Group will own approximately 90% of the shares at the center of a new data center specializing in training and operation of AI systems.ArmIt was reported that there are plans to deploy this technology. Arm, a fabless company, has so far licensed intellectual property rights to companies, but it has been pointed out that if this plan comes to fruition, it will be in direct conflict with NVIDIA.

How Arm could be the unexpected winner of the AI investment boom

https://www.ft.com/content/80a1e79e-b662-40e9-9b41-6d1070f694a8

46% of Nvidia’s Revenue Came From 4 Mystery Customers Last Quarter | The Motley Fool

https://www.fool.com/investing/2024/10/30/46-nvidia-revenue-came-from-4-mystery-customers/

With the rise of AI in recent years, Arm’s revenue has increased rapidly, and its market capitalization has risen to approximately $ 157 billion (approximately 24 trillion yen) at the time of article creation. This is a big difference from Intel’s approximately $95 billion (approximately 14.5 trillion yen).

“We’ve seen tremendous advances in AI as a whole over the past few years, and the amount of innovation that AI will bring is going to be incredible,” said Arm CEO Rene Haas. .

As AI becomes more popular, Arm is striking a good balance with NVIDIA, and NVIDIA isB200While developing AI processors such as “, Arm-based central processing units (CPUs) have been developed.

However, SoftBank CEO Masayoshi Son wants SoftBank to capture a much greater economic value for its processors than the current Arm design provides, and to that end, it wants to create a system that specializes in the training and operation of AI systems. There are plans to open a new data center. In addition, since Arm technology will be placed at the center of the data center network, we are asking Arm to shift away from the traditional business model of licensing only intellectual property rights.

According to the Financial Times, an overseas media outlet, Son’s ambition is to push Arm from an IP licensing business to a company that can manufacture chips for data centers needed to train or build AI models. It was also noted that its acquisition of British chipmaker Graphcore in September was also a result of its search for expertise in bringing chips into production.

Softbank acquires British AI chip maker “Graphcore” – GIGAZINE

NVIDIA has established itself as a top runner in the AI market, and a former Arm executive said, “It would be great for Arm to replicate NVIDIA’s overwhelming computing power and long-established community of AI developers.” “It’s a challenge. I tear up when I think about the investment we need to make to step out of our framework as a fabless company and compete with NVIDIA.”

Still, Haas says, “Future AI workloads will be handled by Arm in some way. That’s why we’re spending a lot of time talking with Softbank about the future.” .

However, Haas acknowledged that it would take “a lot of heavy lifting” for Arm to replicate the entirety of NVIDIA’s technology, including not just the chips but the networking technology and software, and that Arm’s Neural Processing Unit (NPU) Since it is aimed at edge devices such as smartphones and not data centers, it is said that it does not have the performance level of NVIDIA’s AI processor. Still, he said, “There’s a lot of work underway on how to extend our NPU beyond edge devices such as smartphones.”

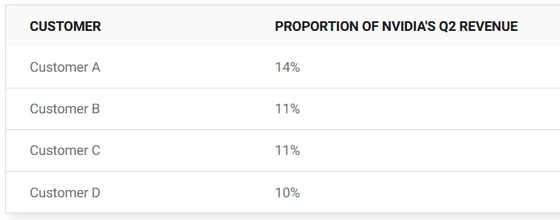

In addition, NVIDIA, a potential rival to Arm, announced its financial results for the second quarter of fiscal 2025 on August 28, 2024, with sales increasing 122% year-on-year to $30.04 billion (approx. 600 billion yen).

NVIDIA announces financial results for the second quarter of fiscal year 2025, with sales exceeding 4.3 trillion yen, an increase of 122% year-on-year, and the data center sector hits a record high – GIGAZINE

In its financial results report, NVIDIA reported that just four companies, “Customer A,” “Customer B,” “Customer C,” and “Customer D,” accounted for approximately 46% of NVIDIA’s second quarter sales. Masu. The Motley Fool, an overseas media outlet, predicts that customer A will be Microsoft, and that either Amazon, Alphabet, Meta, Oracle, Tesla, or OpenAI, which are investing heavily in AI infrastructure, will be “customer B” or “customer C.” ” I guessed that it might fall under “Customer D.”

On the other hand, The Motley Fool pointed out, “If one or two of these top customers reduce spending, NVIDIA could incur irreparable losses.”

Copy the title and URL of this article