|

After the failed acquisition of Siltronic AG, Taiwanese semiconductor wafer manufacturer GlobalWafers, one of the largest in the world, is changing its strategy. Instead of growing through the acquisition of assets abroad, the company will focus on expanding production capacity in the countries where it operates. In this way, GlobalWafers’ management hopes to insure itself against unfavorable events for business, such as an increase in import duties on semiconductor materials during the next round of escalating confrontation between states in the geopolitical arena.

GlobalWafers Changes Strategy

Semiconductor company GlobalWafers is rapidly expanding its production capacity abroad, fearing higher import duties on raw materials used in the production of integrated circuits, Bloomberg reports.

According to the agency, one of the largest chip suppliers is scaling the production infrastructure of its enterprises in six countries, including the United States, Italy and Denmark. In total, GlobalFoundries production sites operate in nine countries.

“I believe that not only in the U.S. but in some other countries, there will be special tariffs on the industry,” GlobalWafers Chairman and CEO Doris Xu (Doris Hsu) – “Tariffs can be avoided by switching to local production.”

GlobalWafers fears disruption in supply of raw materials for semiconductor wafer production

More and more governments are looking at the semiconductor industry through the prism of national security, including taking into account the negative experience gained during the recent covid-19 pandemic. Sanitary measures taken in several countries then led to the destruction of long-established and well-established supply chains for integrated circuits, as a result of which many industries, in particular the automotive industry, were seriously affected. Growing geopolitical tensions are also contributing to increased risks for business, notes Bloomberg.

A painful but valuable experience

According to Xu, today’s approach to doing business is largely dictated by the geopolitical situation. The company she leads has had the opportunity to see this for herself.

In 2022, GlobalWafers failed to obtain approval from the German government to acquire German company Siltronic AG for €3.75 billion. The deal would have instantly made GlobalWafers the world’s second-largest 300mm silicon wafer maker. The deal was not formally rejected – the national regulator did not have enough time to study all its aspects. Some experts suggested that the real motive for the German authorities to fail the deal was the desire to preserve the remnants of the state’s technological sovereignty.

Be that as it may, the acquisition of GlobalWafers had to be abandoned, and on very unfavorable terms for itself: the agreement with Siltronic provided for the payment of a penalty of $50 million to the Taiwanese company for the failure of the deal.

Before the Siltronic saga, more than 80% of GlobalWafers’ growth was driven by the company’s smart work in the M&A market, Xu notes. In recent years, however, this strategy has ceased to bear fruit, as significant difficulties have emerged in acquiring assets from foreign companies.

“We changed our policy because it was becoming increasingly difficult to do any cross-border M&A,” said the CEO of GlobalWafers. “That’s why we are expanding into six countries at once from 2022.”

US and China trade blows in trade war

The fears of the GlobalWafers management regarding the possible escalation of trade wars, in which the tone is set by the USA and China, cannot be called unfounded.

In August 2023, China imposed restrictions on the export of rare earth metals – gallium and germanium, widely used in the production of semiconductors and traction batteries for electric vehicles. In December 2023, a ban was introduced on the supply of technologies for processing raw materials of this type abroad. In July 2024, it became known about China’s plans to nationalize all reserves of rare earth metals in the country.

The United States, in turn, in May 2024 raised import duties on electric vehicles, solar panel components, and certain types of aluminum and steel products produced in China.

GlobalWafers on the Road to Recovery

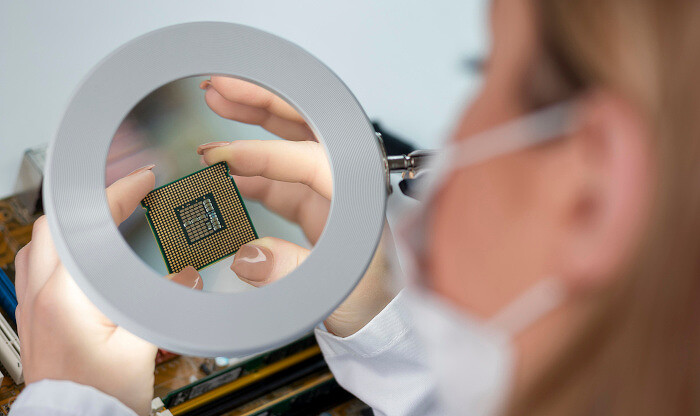

GlobalWafers was founded in 2011 and is headquartered in Hsinchu, Taiwan. The company manufactures advanced semiconductors for electronics.

Tax Monitoring. New Horizons of Digitalization. What Awaits Us in 2024-2025

Market

As of 2022, GlobalWafers ranked third in the world in terms of volume of 300mm silicon wafers shipped to the market. The company’s main competitors are Japan’s Sumco and Shin-Etsu Chemical.

GlobalWafers is majority owned (51%) by Sino-American Silicon Products Inc (SAS). The company’s operations began in 1981 and its first silicon wafer was manufactured in 1982.

According to Doris Xu, GlobalWafers is aiming to regain its lost ground as the market gradually recovers. The company peaked in market capitalization in 2021 and has since fallen by almost half. The reason is a huge decline in sales due to lower demand in the consumer electronics and automobile markets at the beginning of the post-pandemic period.

The company has already managed to attract significant funds to expand its production capacity. In particular, GlobalWafers received a grant of 103 million euros from the European Commission and the Italian government to build a new plant for the production of 300-mm wafers in Novara (Italy). The company will also receive $400 million in accordance with the US Chips Act program to expand sites in Texas and Missouri.

Dmitry Stepanov